How to plan expenses for ZFŚS? Sample of ZFŚS expenditure budget

June 2021 Update: Employers with at least 50 employees on an employment contract are obligated to create a Company Social Benefits Fund. This allows for material and non-material support of employees, motivating them to work more efficiently, and increasing their engagement and loyalty to the company. However, in order to avoid complications in granting benefits, it is important to plan expenses for the year beforehand. How to do this? What should be used to finance the Company Social Benefits Fund? And how to create a preliminary list of expenses? We explain.

- Sources of financing for the Company Social Benefits Fund in 2018.

- Preliminary list of expenses for the Company Social Benefits Fund

- Correcting the size of allocations

June 2021 Update

Sources of financing for the Company Social Benefits Fund in 2018

First of all, it should be noted that financing the Company Social Benefits Fund is primarily made possible through allocations made by employers, which may change in amount in a given year. How is this calculated? It is assumed that the average salary, which is the basis for calculating allocations, is equal to the average monthly salary in the national economy in the second half of 2018, which is PLN 4,134.02.

What does this look like in practice? In 2021, an allocation of PLN 1,550.26 (37.5% of the employee’s base salary) should be made for each employed employee. In the case of employees working in difficult conditions, the amount increases to PLN 2,067.01, which is 50% of the base salary.

For each young worker, an allocation of PLN 206.70 (5%) should be made in the first year of learning, PLN 248.04 (6%) in the second year of learning, and PLN 289.38 (7%) in the third year of learning.

In the case of persons with a disability, an allocation equal to 43.75% of the base salary, or PLN 1,808.64, should be made. Since social assistance can be provided to retirees and pensioners for whom the company was their last place of work, the employer may make an allocation increased by 6.25%, or PLN 258.38, in 2021.

In the company, a separate account for the Company Social Benefits Fund may be opened, in which all allocations will be deposited.

Preliminary Expenditure Budget of the In-House Social Benefits Fund

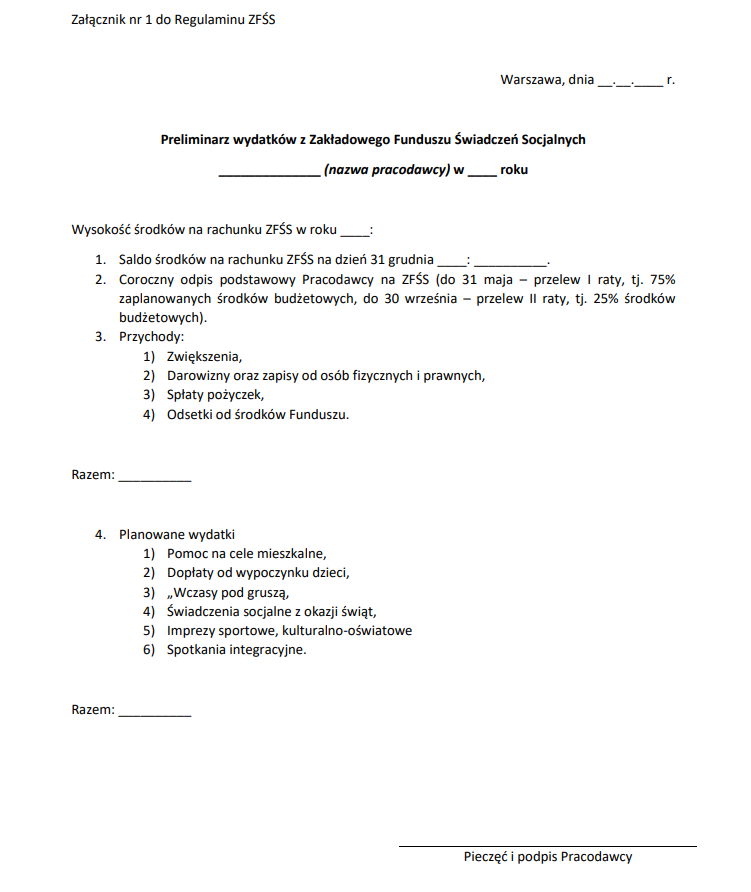

Although creating a preliminary expenditure budget is not mandatory, most companies decide to create a detailed plan in which the amount of money to be allocated to specific social activities is determined.

The basis for creating the preliminary budget is the pool of funds obtained from contributions, so knowledge of their size is necessary. However, to match the benefits to the needs of employees, it is also important to consider how benefits were used in previous years and by whom and to what extent. Our cafeteria system (what is a cafeteria compensation system) can come in handy here, as it not only makes it easier to settle accounts from the In-House Social Benefits Fund, but also enables the generation of necessary statistics.

Most often, such a budget plan consists of two parts: revenues and planned expenses. Revenues include the size of contributions, donations, and entries from individuals and legal entities, unused funds from previous years, or interest on funds in a bank account. In the part concerning expenses, estimated amounts that will be allocated to various forms of social activities should be determined. You can use a sample preliminary expenditure budget from the In-House Social Benefits Fund, which should make it easier to create your own document. It is also important to remember that this is an estimated plan that usually changes throughout the year.

Adjusting the Size of Contributions

When determining the funds that can be included in the preliminary expenditure budget, you first need to plan the amount that will be transferred to the In-House Social Benefits Fund bank account. It is important to know that the account must be funded in two installments. The first installment is at least 75% of the equivalent of the basic contribution and should be transferred to the fund’s bank account by May 31st, and the second installment covers the remaining part and should be transferred by September 30th at the latest.

Due to the fact that it is impossible to predict all circumstances that may affect the size of contributions, it is advisable to plan a preliminary budget with a certain margin of error. In the event of significant changes in the financial situation of the company or employees, it is possible to correct the size of contributions by submitting a relevant application to the Social Insurance Institution.

Please note that these are only estimated plans. At the end of the year, a correction of the provisions can be made based on the actual number of employees from each month. If it turns out that the average number of employees is lower than the actual, you can: withdraw the surplus from the Social Benefits Fund to the company account or reduce the next year’s provision for social activities by the surplus amount.

On the other hand, if the planned level of employment is lower than the actual, additional funds should be transferred to the Social Benefits Fund. Such correction can also be made during the year, before transferring the first or second payment, but a final correction will still have to be made in December.

Issues related to provisions for the Social Benefits Fund and the creation of a preliminary estimate of expenditures are complicated, so it is worth using the help of experienced people. The introduction of a cafeteria system in the company can also facilitate the management of non-wage benefits.

Recent Posts:

- Capital24.tv Debate with Piotr Dubno – “Economy, Innovation, Investments. What Changes Await Us?

- The future of HR – what will be the key to organizational success?

- Are you keeping up with the idea of a modern workplace?

- Burnout, how can an employer help an employee?

- Digitalization of HR is key to unlocking the full potential of an organization